Clients We Serve

Specialized Planning for Corporate Executives

Our clients are successful people with a lot on their proverbial plates.

Many of them are self-made entrepreneurs or c-suite executives of companies that are positioned for sale. They’re successful, driven, and because of that, they’re busy. Our goal is to reduce their stress by organizing their financial worlds and carrying the burden of wealth management. We intentionally limit the number of clients we serve in order to offer them the highly attentive, comprehensive service they deserve.

Specialized Knowledge

We specialize in addressing the essential financial issues associated with compensation for executives at public and private corporations, such as managing stock options and mitigating concentrated equity risk. Our goal is to help you identify your objectives and design a strategy that addresses taxes, estate planning, trusts, and more.

Detailed Review

We believe all executives should receive thorough and knowledgeable guidance on their financial plans. Having just one overlooked part of your executive compensation strategy could have negative tax consequences and potentially be the difference in achieving your life goals or not.

Extensive Support

As your partner, we offer guidance for myriad planning issues such as cashless stock option exercises, Rule 144 executions, 10b5-1 sales plans, share repurchase programs, corporate cash management, executive benefit platforms, generational wealth transfer, and philanthropic objectives.

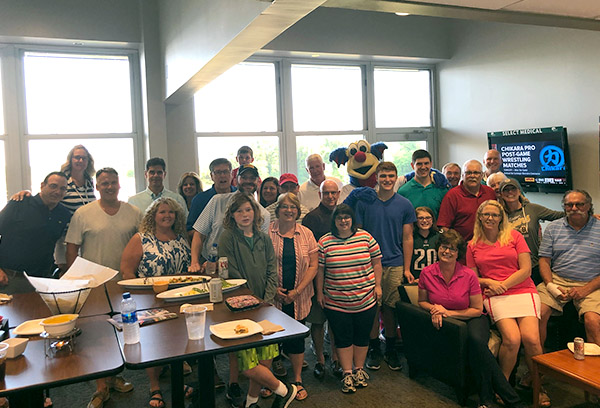

Relationships are Everything

Our work is about helping incredible people live fulfilling lives, and we genuinely love spending time with the people we serve. We regularly host client events so we can get to know you and your family on a personal level and experience life together.